Industries & Products | Cigarette Industry

Japan Tobacco Bangladesh

Japan Tobacco

Japan Tobacco Inc. or JT is the fourth largest tobacco company in the world in terms of shares of the global tobacco market[1]. The company became the second largest multinational tobacco company in Bangladesh after its acquisition of Akij Group's tobacco business - United Dhaka Tobacco Company Limited aka Dhaka Tobacco for $1.47 billion (about BDT 124.3 billion).

History of Japan Tobacco Inc.

Japan Tobacco Inc. or JT is the successor entity to a nationalized tobacco “Monopoly Bureau”, first established by the Government of Japan in 1898 to undertake the exclusive sale of domestic leaf tobacco. On June 1, 1949, the Monopoly Bureau became the Japan Tobacco and Salt Public Corporation or JTS. Japan Tobacco Inc. or JT came into being in 1985, as an entity that took over the whole of the business operations and assets of JTS and opened Japanese tobacco market to foreign tobacco manufacturers.[2],[3]

In 1999 JT acquired the non-U.S. tobacco business operations of R.J. Reynolds Nabisco Inc. and Japan Tobacco International or JTI is founded. JT International (JTI) is an operating division of Japan Tobacco Inc., handling the international production, marketing and sales of the group's cigarette brands.

The JTI Foundation, an entity that describes itself as “charitable organization registered under Swiss law and financially endowed by JT International SA” was established in 2001 and currently has projects on disaster management in at least 25 countries, including Bangladesh.[4]

Japan Tobacco in Bangladesh

JTI entered in Bangladesh market in 2015 with Winston cigarette and held a paltry 0.1 per cent market share as of 2017 (before its acquisition of Dhaka Tobacco), according to the company’s estimates. United Dhaka Tobacco Company Limited, concern of the local Akij Group, was acting as a contract manufacturer and distributor of Japan Tobacco's Winston brand and Philip Morris's Marlboro brand since 2015.[5]

On the other hand, JTI Foundation, a charitable organization endowed by JT International, began to fund for social service and sustainable development activities in Bangladesh from 2015.[6] It is alleged that JTI Foundation has been the key to JTI’s penetration into Bangladesh.

On 8 August of 2018, Japan Tobacco Inc. acquired Akij Group's tobacco business - United Dhaka Tobacco Company Limited aka Dhaka Tobacco for $1.47 billion (about BDT 124.3 billion), which was the biggest ever single Foreign Direct Investment (FDI) in the private sector of Bangladesh. Japan Tobacco bought shares of Dhaka Tobacco at $1.09 billion and paid $386 million for trademarks and design rights of the latter.[7]

The acquisition deal was openly lauded by a number of high-level govt. officials. Mr. Kazi M Aminul Islam, the then Executive Chairman of Bangladesh Investment Development Authority (BIDA), had commented that this acquisition would add at least $100 million to export receipts. Commenting on the acquisition deal, Japan Tobacco said in a statement, “With this investment, we continue to accelerate our expansion in emerging markets that matter, a key component of Japan Tobacco Group’s growth strategy.”[8]

The acquisition marks an aggressive push by the Japanese company into new markets as sales of its products in developed countries are shrinking as more people quit smoking, says Forbes in its article on the acquisition[9]. According to Reuters, “Japan Tobacco Inc (2914.T) is buying the tobacco business of Bangladesh’s Akij Group for around $1.5 billion, its second major purchase in five months as the world’s third-biggest cigarette maker seeks new growth markets to offset shrinking sales at home.”6

Context: Market Opportunity in Bangladesh for JTI

Bangladesh is the world’s 8th largest cigarette market with volumes exceeding 86 billion units and an annual increment of 2 percent for the cigarette industry. Akij’s United Dhaka Tobacco Company Limited was the country's second-largest tobacco company with a 20% share of the market, according to JT's statement during the announcement of the deal between the two companies.7 According to Mr. Mutsuo Iwai, the Executive Vice President and President of the JTI’s Tobacco Business, Akij’s substantial market share places JTI straight at the number two position in Bangladesh, which will expand their quality top-line growth.

Tobacco Industry Watch BD, in its July 2018 editorial comments[10],

“Currently, the youth consists of 31 percent of the total population of Bangladesh. So, this young generation is the main target of JT, the fourth largest tobacco company in the world. … It should be noted that the sale of cigarettes in Japan is rapidly shrinking and JT’s business in the local market of Japan has seen a decrease of 5.1 percent. Japan has just introduced a set of stern tobacco control regulations in recent months, penalizing public smoking heavily which has caused quite a sit. The expansion of JT’s business into other countries with lax tobacco control and govt. mentoring is thought to be a move to offset shrinking sales at home.”

Brands, Products and Market Shares

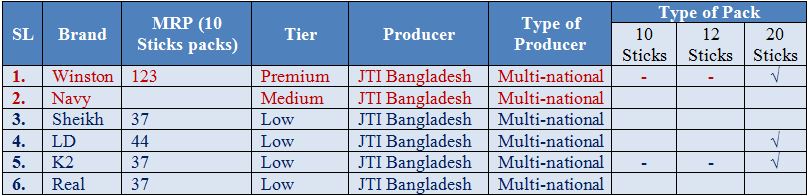

As of 2020, JTI holds 20 percent of the country’s cigarette market. Alongside their original brand i.e.: Winston, the Bangladesh operations of JTI is also manufacturing and selling the popular cigarette brands of their predecessor United Dhaka Tobacco Company Limited. Below is a chart of their various brands and their prices.

Aggressive and Stealthy Marketing Campaign

According to the Smoking and Tobacco Products Usage (control) Act 2005 of Bangladesh, advertisement and promotion of any tobacco product is a punishable offense. Article 5 of the 2005 Act defines ‘the advertisement of tobacco products’ as conducting any kind of commercial activities with intention of directly or indirectly encourage the use of tobacco or tobacco products. The Act also bans the promotion of tobacco products at the point-of-sale.

Since 2018, JTI has been pushing its brands aggressively. POS promotion and advertisement through leaflets, stickers and dummy packets, breakfast campaign of BDT 10, use of brand color and tagline on staff uniforms and delivery vehicles, promotional game shows, movie carnivals, gift offers for retailers as well as consumers, and most of all – the use of mass media along with social media – JTI have done them all to instill their presence in the market of Bangladesh.

In 2019, an advertisement on a documentary titled Footsteps of Tagore was broadcast in numerous Bangladeshi television channels. The slogan of the documentary and the background color on which it was promoted are completely identical to that of JTI. The promotional campaign for that documentary included wall posters, shop display boards as well as Google Ads on numerous websites. The unprecedented promotion of the documentary was to allegedly promote and familiarize JTI brand.

References

[1] Campaign for Tobacco Free Kids (CTFK), The Global Cigarette Industry, December 2018, accessed July 2020

[2] JT Group, Our History, undated, accessed June 2020

[3] Wikipedia, Japan Tobacco, undated, accessed June 2020

[4] JTI Foundation, About Us, undated, accessed May 2020

[5] Single biggest FDI in Bangladesh: Japan Tobacco snaps up Akij's tobacco business for $1.47 billion, The Daily Star, 7 August 2018, accessed June 2020

[6] JTI Foundation, Our Programs, undated, access May 2020

[7] Japan Tobacco to buy Akij tobacco in Bangladesh for $1.48b, Daily New Age, 6 August 2018, accessed May 2020

[8] Japan Tobacco buying Bangladesh Akij's tobacco business for $1.5 billion, Reuters, 6 August 2018, accessed May 2020

[9] A. Kabir, Japan Tobacco Jumps Into Bangladesh Market With $1.5 Billion Deal, Forbes, 6 August 2018, accessed May 2020

[10] PROGGA, Editorial: Public Health on Top, Tobacco Industry Watch BD E-newsletter, July 2018, accessed May 2020